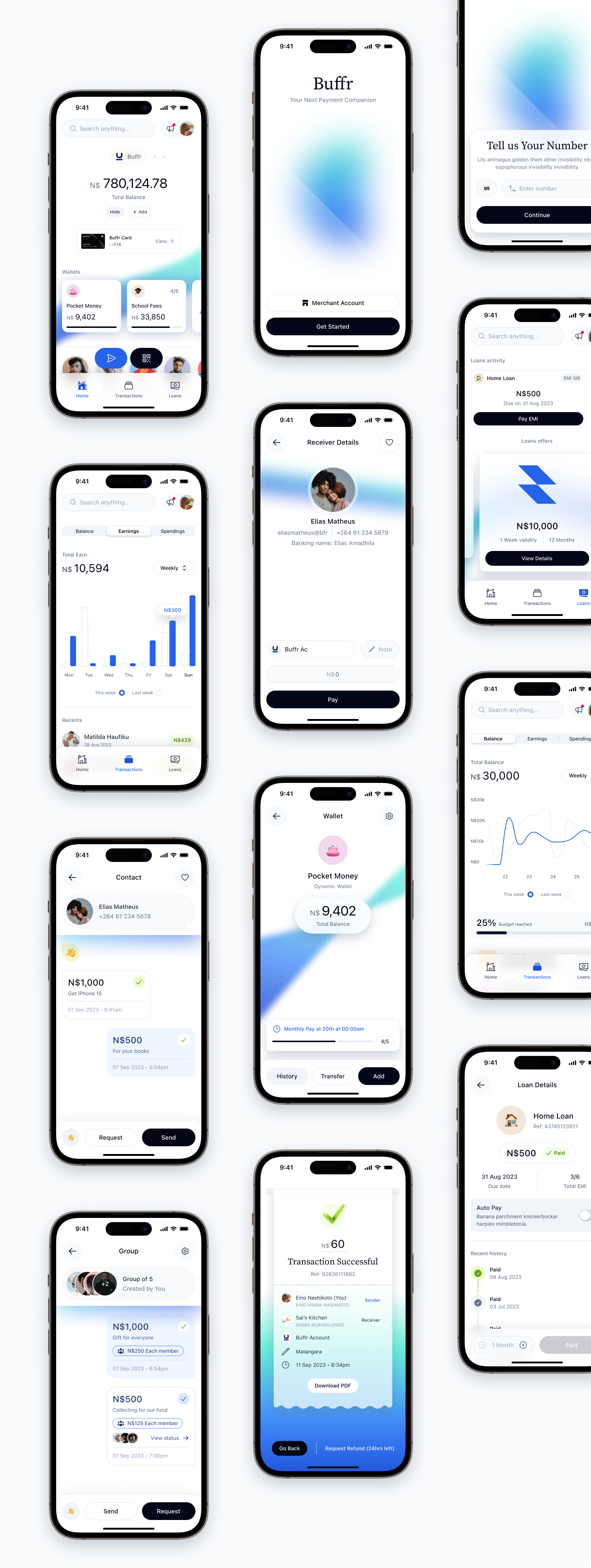

Buffr - Your Next Payment Companion

A comprehensive fintech ecosystem tackling institutional challenges in Namibia's financial sector, including the 24.7% informal economy, rural access barriers, and financial literacy gaps through AI-powered solutions.

Winner of the 2023 Asper Student Startup Prize in Apps, Software and Computer Science category. Founded by George Nekwaya, MBA'24, revolutionizing financial inclusion across Southern Africa.

Read Award Article

Award-Winning Innovation

Buffr took home first place in the Apps, Software and Computer Science category at the first-ever Asper Student Startup Prizes competition at Brandeis International Business School.

Founded by George Nekwaya, MBA'24 and Evan Goddard, MSF'24, Buffr aims to transform the financial landscape in Southern Africa, beginning with Namibia.

About Buffr

Addressing Critical Financial Inclusion Challenges

Our Mission

Buffr is an innovative fintech startup addressing critical institutional challenges in Namibia's financial sector. Our mission is to bridge the gap between formal and informal economies through AI-powered solutions that address the 24.7% informal economy, rural access barriers, and financial literacy gaps. We provide comprehensive financial services including group lending, seller verification, financial literacy education, and AI-powered financial assistance tailored to Namibia's unique economic landscape.

The Challenge We're Solving

- 24.7% of Namibia's GDP comes from the informal economy with limited digital footprint

- 40km average distance to financial services in rural areas creates access barriers

- Limited financial literacy and digital financial education resources

- No data → No rating → No credit cycle prevents informal economy formalization

Buffr Product Ecosystem

Comprehensive AI-powered financial solutions for individuals and businesses

BuffrLend

B2B2C Lending Platform

"Enterprise Lending Platform"

Complete B2B2C lending platform with AI-powered KYC verification, comprehensive loan processing, and enterprise CRM system for institutional employers.

BuffrSign

Digital Signature Platform

"Get Documents Signed in Minutes, Not Days"

Advanced AI-powered digital signature platform with intelligent document processing, compliance validation, and secure signature workflows.

Buffr Host

Hospitality Management

"The Future of Hospitality, Today"

Comprehensive cloud-based hospitality ecosystem management platform combining CRM-driven customer engagement and AI-powered business intelligence for restaurants and hotels.

Strategic Alignment with National Initiatives

Buffr is strategically positioned to complement the Bank of Namibia's Instant Payment Project, which aims to modernize the country's payment infrastructure. As the central bank works to implement real-time payment capabilities and interoperability standards, Buffr serves as a consumer-facing interface that leverages this evolving infrastructure.

How Buffr Addresses Institutional Challenges in Namibia's Informal Economy

Buffr's approach to institutional challenges in Namibia's informal sector is rooted in practical, technology-driven solutions that target the root causes of exclusion and inefficiency. Rather than simply listing features, our strategy is to close the data, credit, and compliance gaps that hinder financial inclusion and economic growth.

- • Data Visibility for Micro-Enterprises: We enable real-time transaction data capture and analytics (via Apache Fineract integration), giving micro-sellers a digital footprint and actionable business intelligence.

- • Simplified Tax Compliance: Buffr integrates Namibian tax rules directly into the app, automating tax calculations, presumptive tax filing, and compliance reporting for informal traders.

- • Inclusive Credit Scoring: Our AI models use transaction and behavioral data to generate fair credit scores for users with no formal credit history, breaking the "No Data → No Rating → No Credit" cycle.

- • Regulatory Alignment: We provide built-in KYC/AML workflows, audit trails, and risk assessments to help users and partners meet NAMFISA requirements.

- • Financial Literacy & Engagement: Gamified modules, progress tracking, and community features foster financial education and encourage positive financial behaviors.

- • Personalized AI Assistance: Users receive real-time tax calculations, financial coaching, and actionable insights from our AI-powered assistant.

- • Actionable Financial Insights: The platform delivers spending analysis, savings tips, debt management tools, and risk assessments tailored to each user.

- • Comprehensive Analytics: Users access dashboards with spending patterns, savings trends, and personalized financial health scores to inform better decision-making.

- • Financial Literacy Calendar: Personalized learning calendar with Namibian context, progress tracking, and gamified financial education modules.

Professional Experiences

Highlighting key events that shape my fintech journey.

FinTech Junction 2023

Attended Israel's premier fintech conference, FinTech Junction 2023, held at the Hilton Tel Aviv. This event brought together over 1,000 attendees from 25 countries, including leaders from banks, fintech startups, and venture capital firms. I gained insights into global fintech trends, particularly in AI-driven innovation and digital payments, and had the opportunity to network with industry leaders, enhancing my understanding of the challenges and opportunities in the fintech landscape.

Black in eCom 2023

Attended the Black in eCom Conference 2023, a pivotal event focused on empowering Black entrepreneurs and professionals in e-commerce and technology. The conference aimed to amplify Black voices in e-commerce, celebrate their contributions, and address industry challenges through networking, education, and empowerment initiatives.

MIT FinTech Conference 2024

Engaged with innovators and professionals at the MIT FinTech Conference 2024. The conference addressed pressing issues in fintech, including real-time payments and AI applications in finance. I participated in discussions led by industry leaders from Visa and PayPal, gaining valuable insights into the future of financial services and the role of technology in enhancing customer experiences.

MIT FinTech Conference 2025

Continued my engagement with cutting-edge fintech discussions at the MIT FinTech Conference 2025. This conference focused on the impact of open banking, AI, and digital currencies on financial services. I participated in networking opportunities, discussing strategies for navigating the evolving financial ecosystem and the importance of customer trust in adopting new technologies.

Connect With George Nekwaya

Founder & CEO of Buffr Inc. | Fintech Innovation Leader | AI/ML Specialist

Location

Windhoek, Namibia